With the UK weather turning colder over the last week, it's time to take a look at how our creaking gas and electricity infrastructure might cope this winter. I'll look at two areas - first, National Grid's Winter Outlook for 2013/14, and second, my own analysis of their data on UK gas storage.

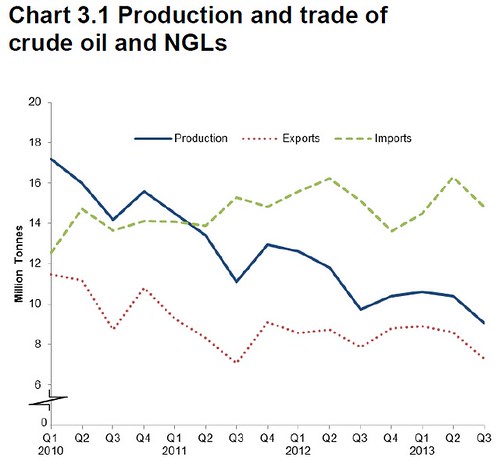

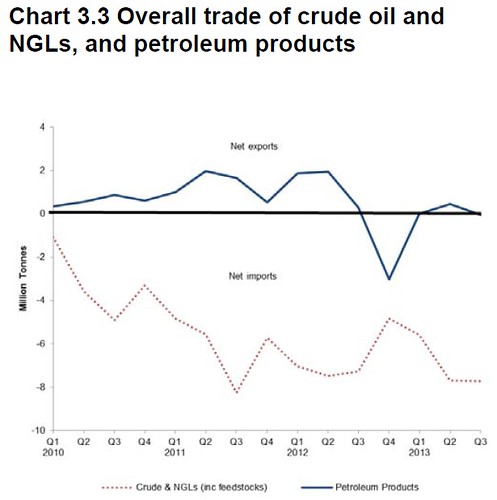

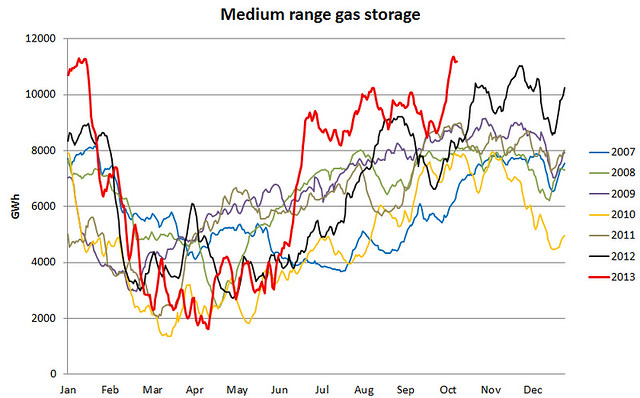

Most of National Grid's Winter Outlook is dedicated to gas, as the supply/demand is affected much more than electricity by the availability of imports and how cold the weather is. The report indicates that there is, in theory, plenty of gas supply for even the coldest weather that the UK could experience. In practice, however, situations can arise where supplies are far from secure. For example, earlier this year an unseasonably cold March coincided with a brief outage in the Bacton Interconnector, resulting in gas storage levels dropping to record lows. LNG imports were low at the same time, due to demand from Japan and China - this has not changed since then. The situation is illustrated well by a graph from from page 13 of the Winter Outlook, where the 2012/13 line can be seen going off the cold end of scale in March:

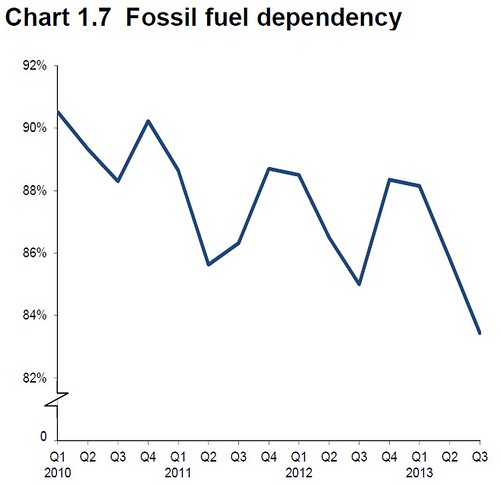

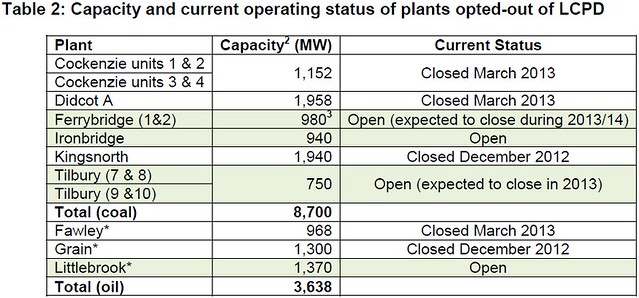

This exposes the other flaw in our gas market - if it is cold in Europe at the same time as it is cold here, there's no guarantee that gas suppliers in France, Germany and elsewhere won't keep gas for local use due to obligations placed upon them. Alastair Buchanan, the former head of OFGEM who stepped down from his post in June after 10 years’ service, comments on this in an interview with The Telegraph, and goes on to say that uncertain gas supplies combine with ageing power stations in the UK to create a real risk of temporary blackouts if the weather is cold over the next few winters. Over 40% of the UK's electricity is generated by burning gas, so the two are closely linked. In the Winter Outlook, National Grid notes that the margin of spare electricity generating capacity this winter would only be 5% during a cold spell, compared to 17% just two years ago.

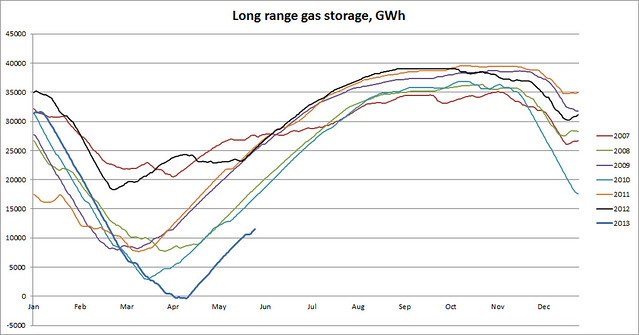

Moving on to the current state of our gas stores, here's some graphs I've plotted using data available from the National Grid website. First, here's the amount of gas in Long Range Storage, which is basically a single depleted gas field known as Rough, owned by Centrica. 2013 is in red on the graph.

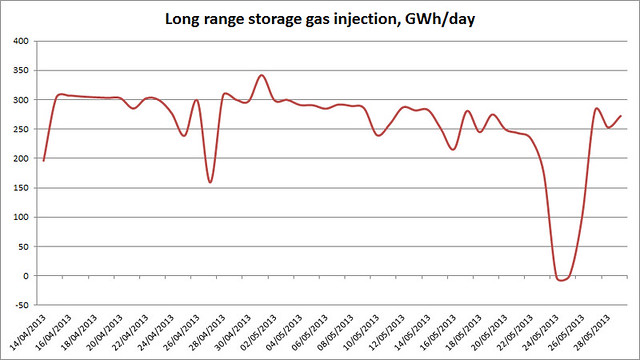

As you can see, the main factor affecting the storage levels in Rough this winter is what happened last winter. The cold weather dragging on through March and April resulted in the storage level actually going below 'zero' (see my blog at the time for an explanation), so we've been playing catch-up all summer and the current level is lower for this date in October than any time since 2007 (when North Sea supplies were much greater than today...). There's little hope of the storage getting filled up to the higher levels seen in the past few years, partly due to physical limits to how fast gas can be pumped in and partly due to the rising cost as we go into winter. The rate at which Rough has been filled this year is shown in the graph below. Why they decided to take a break from filling it at some points is beyond me...

You'd think that someone would be building more storage space for gas, but a recent story in The Telegraph noted that:

Centrica has written off £240m in wasted costs after scrapping its £1.4bn plan to convert an empty North Sea gas field into a gas storage site, and shelving another smaller project indefinitely.

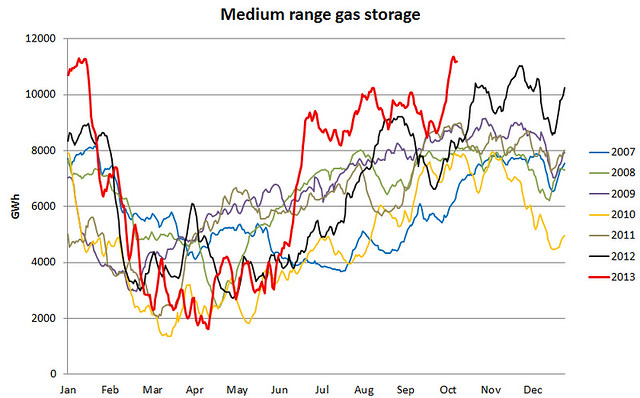

The situation with Medium Range Storage is not so bad, though this doesn't fully compensate for the current shortfall at Rough:

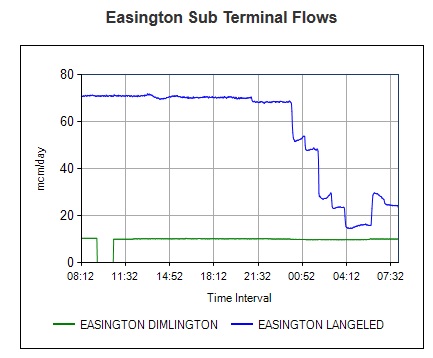

Short Range Storage is very low, but the amounts required to fill it up are relatively small. It does still need doing though, as these stores are critical to cover unexpected outages, which seem to occur regularly enough that the may as well be expected these days...

Of course, the question that most people will be asking is 'What will happen to prices?' Well, I said in a

post on this blog in May 2013:

This can only translate into higher bills eventually, although the bumper profits made last winter may result in a short delay before this happens. Boosted gas prices will feed through into electricity prices too.

Lo and behold, one of the 'big six' have already

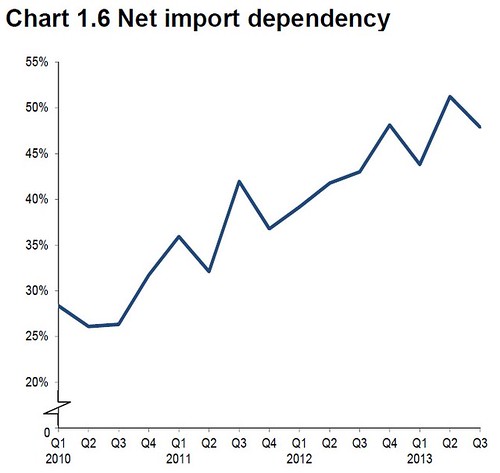

put up their prices, and I'm sure the others will follow suit. I know they blame 'green taxes' and transportation costs, while the government blames fat profits in the upstream sections of the energy companies, and there is a little truth in all these claims, but the simple fact is that in the year ending 30 June 2013 we imported over 50% of our gas (data from

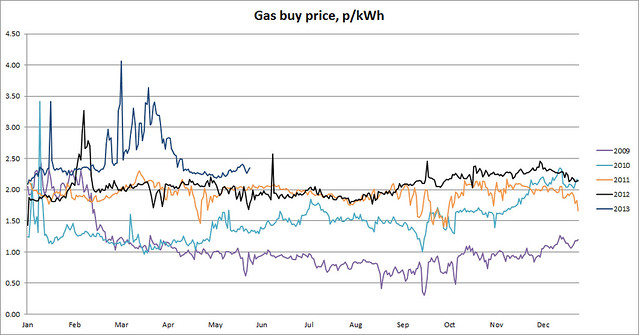

DECC). This means that we are at the mercy of European and global demand and weather. The graph I've plotted below shows spot market prices as reported by National Grid over the past few years. The trend is clear, and the average price this year so far is currently up 18% on the year before, in part due to the very low storage levels at the start of the summer.

I will of course be keeping an eye on gas storage levels, and the weather forecast, over the coming 4-5 months, and don't forget you can check the current gas situation yourself at National Grid's

Prevailing View page.

If you're wondering what else you can do, at the risk of repeating myself, you can:

- Reduce demand (wear warmer clothes, turn the thermostat down, don't boil a saucepan without a lid on it, etc.)

- Improve efficiency (insulate your house, draughtproof, double-glaze, etc.)

- Use renewable energy

There's some examples of what we've done at home for the above points

here, and you can check out some inspiring ideas on the

Ashden website too.

Keep warm, and pray that we don't get too many days that look like this in the coming winter...

Mike

Click here to read the rest of this post.